Session 1

1. Lifestyle Planning

- Planning for retirement is so much more than just calculating facts and figures. This section touches on how retirement has changed and evolved throughout the years and continues to do so. Identifying expectations for life after work is an important item to address, including planned adventures, day-to-day activities, caring for loved ones, and exploring your unique vision of retirement.

2. Expenses In Retirement

- A common concern for those approaching retirement is oftentimes: “How much do I need to retire?” While nobody can answer with absolute certainty, determining the needs and wants in retirement is a step in the right direction, while accounting for the unexpected. All retirees need a plan for preserving their purchasing power (inflation) in retirement.

3. Debt Management & Tax Planning

- Differentiate between good debt and bad debt, learn how to use debt as a tool, and considerations for carrying debt into retirement. Simple, practical, and effective tax strategies are expanded upon in section 3. Keep more of what’s yours!

Excerpt from SRS Session 1 textbook

4. Income Planning

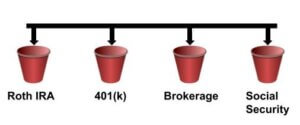

- Traditional and Roth IRAs, Social Security Income strategies, maximizing your employer-sponsored retirement account(s), and additional income sources are included in this section. Are you confident in the amount you are saving, and where your savings are being held?

5. Distributions in Retirement

- Being able to retire is a remarkable feat to be proud of, many sacrifices were made and a strong sense of discipline was required. Don’t place your hard work in contention with ineffective distributions from your retirement savings. A structured plan of action to fund goals post-retirement should be built around the individual while avoiding costly mistakes.

Session 2

6. Investments

- Section 6 explains much of the foundational knowledge required to be a successful investor. Whether you plan to be a DIY investor or entrust a fiduciary to manage your money, a basic understanding of where and how your savings are invested should not be discounted.

Excerpt from SRS Session 2 textbook

7. Risk Management & Asset Protection

- Learn about the various types of insurance, how to determine which policies are best for you, and which are mostly commission-motivated products for insurance salespeople. A Medicare overview and the in’s and out’s of Long Term Care are expanded upon.

8. Legacy/Estate Planning

- Estate planning is NOT reserved for the wealthy. Educate yourself on tried-and-tested estate planning strategies, potential estate/death taxes, and incapacity considerations to take into account.

Additional Resources and Tools

- Fascinating articles and additional educational resources are great tools to help prepare any reader to plan for a life of financial independence.

Course Topics

LIFESTYLE PLANNING

- Retirement Years Are Unique to Each Couple’s and Each Individual’s Retirement

- Financial Independence

- The Way People Used to Think of Retirement

- Present Day Retirement

- Today’s Retirement Opportunities

- Life Planning for Retirement

- Questions to Consider

- Examine Your Life

- Planning for the Future

- The Essential Basics

- Realistic Expectations About This Course

EXPENSES IN RETIREMENT

- Inflation and Purchasing Power

- Historical Rates of Inflation

- Inflation and Income Taxes

- Retirement Expectations

- How Much Will You Need to Retire?

- Life Planning for Retirement

- When can you retire?

DEBT MANAGEMENT & TAX PLANNING

- Create a Net Worth Statement

- Debt Management

- Types of Debt

- Taxes

- Tax Terms

- 2023 Federal Income Tax Tables

- Tax Strategies

- Taxable Investments

- Investment Tax Rates

- Accounts with Tax Advantages

- Tax Exclusion for Home Sale Gains

RETIREMENT INCOME

- Personal Retirement Vehicles

- Traditional IRA’s

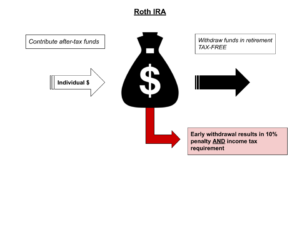

- Roth IRA’s

- Traditional IRA to Roth IRA Conversions

- Review: IRA vs. Roth IRA

- Additional Sources of Income

- Social Security

- Eligibility

- Strategy

- How Are Retirement Benefits Taxed?

- The Future of Social Security

- Employer-Sponsored Retirement Plans

- Qualified Retirement Plans

- Defined Benefit Plans

- Pensions

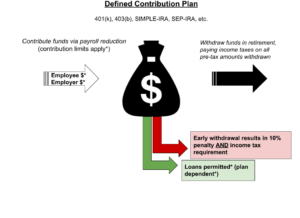

- Defined Contribution Plans

- 401(k), 403(b), SEP-IRA, SIMPLE, 457(b)

DISTRIBUTIONS IN RETIREMENT

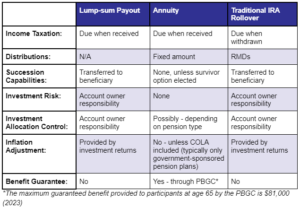

- Defined Benefit Plans (Options)

- Moving Your Retirement Assets

- Stock Market Indexes

- Employer Securities in Retirement Plans

- Annuity Income

- Retirement Distribution Comparison

- In-Service Withdrawals/Distributions

- Required Minimum Distributions

INVESTMENTS

- Cash Accounts and Equivalents

- Bonds

- Bond Interest Rates

- Stocks

- Stock Market Indexes

- Stock Categories

- Stock Terms

- Employee Stock Options

- Mutual Funds

- Exchange-Traded Funds (ETFs)

- Real Estate Investment Trusts (REITs)

- American Depository Receipts (ADRs)

- Investment Risks

- Effective Strategies to Mitigate Risk

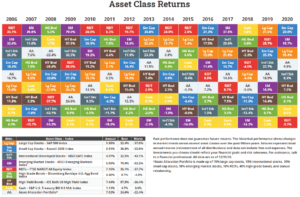

- Asset Class Returns

- Percent of Active Managers Under-Performing the Index

RISK MANAGEMENT & ASSET PROTECTION

- Property and Casualty Insurance

- Disability Income Insurance

- Health Insurance

- Medicare Insurance Premiums

- Medicare Part B

- Medicare Trends

- Long Term Care (LTC)

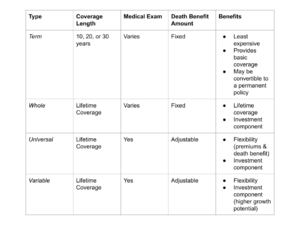

- Introduction to Life Insurance

- Needs and Benefits

- Categories

- Comparison

- Survivorship Life

LEGACY/ESTATE PLANNING

- Estate Planning Objectives

- Planning for Incapacity

- Transfer Taxes

- Estate Planning Basics

- Additional Planning Strategies

- Types of Property Interests.

RESOURCES AND TOOLS

- Financial Terms and Definitions

- Golden Years – Monte Carlo Explained

- Investment Analytical Terms

- Medicare Premium Analysis: Parts B and D

- Retirement Income Plan Worksheet

- Common Retirement Issues to Consider

- Thor’s Guide to Successful Retirement

- Retirement Phase Accumulation Chart

- Market Curses: The five dirty words you can’t Say in personal finance

- 25 Reasons to Diversify

- Perfect Positive Correlation, Perfect Negative Correlation, Imperfect Correlation

- Investing and Emotions

- Asset Class Returns vs The “Average Investor”

- Attempting to pick the exact bottom could potentially be costly

- Chasing Performance May Lower Your Returns

- Consumer Items in 30 Years

- Importance of Asset Allocation

- The perils of market timing

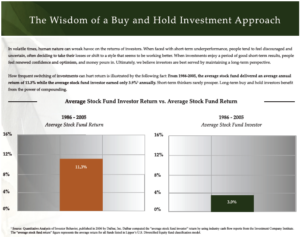

- The Wisdom of a Buy and Hold Investment Approach

- US Capital Asset Historical Returns

- What if you retired in the “lost decade?”

- Prevent Identity Theft